Hey everyone. As mentioned in the latest grant update, it has been brought to our attention that the OP Council would like to see faster distribution and conclusion for the Phase 1 grant. We have discussed suitable options for repurposing that would give high efficiency for the remaining tokens while also providing a clear timeline for their distribution, which we’re presenting in this post.

Please find the original grant application here:

Original Grant Application

And the previous updates to the grant here:

Update Jan 2023

Update Jul 2023

Update Feb 2024

Update Dec 2024

For a quick update, as of today, a total of ~294,214 $OP tokens have been used with 205,786 $OP tokens left. A total of ~303,507 $OP tokens have been additionally bought from the open market that have been paired with the $OP tokens from the grant.

Balancer v3 and Boosted pools

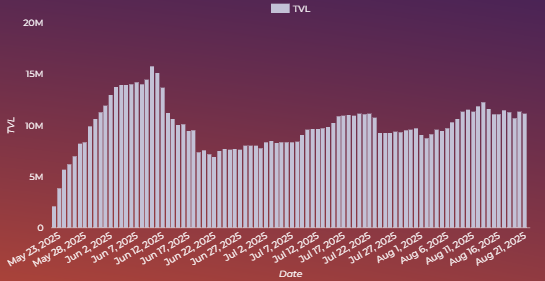

The successful passings of the proposals to deploy Balancer v3 on Optimism Mainnet on Balancer and Beets governance enable relaunching Boosted pools on Optimism. Boosted pools are passive, custom pools built on Balancer v3 that routes 100% of underlying Liquidity Providers (LP) liquidity to external yield markets to generate additional rewards while ensuring all liquidity remains available to facilitate and earn rewards from swaps. Since the underlying tokens are routed to external markets, then every $1 deposited that’s bridged and deposited to boosted pools will increase Optimism’s TVL by $2.

Aave is an example of an external yield market that would act as a possible partner for the boosted pools. Aave boosted pools are already live on Balancer v3 on Ethereum with total TVL over $70M. With Aave Optimism Market having a market size of over $165M, then launching similar pools on Optimism would definitely create lucrative options for users for providing liquidity. This would bring more rewards to Optimism and increase Optimism TVL, with every $1 deposited in a 100% boosted pool increasing the network’s TVL by $2. Other potential partners for boosted pools include protocols such as Compound, Moonwell and Euler.

Repurposed Grant Budget and Plan

Budget

The budget is equal to the amount unused from the initial Phase 1 grant (currently 205,786 $OP tokens). Since the Phase I grant is still on-going until the repurpose is approved, then that number will likely decrease a bit before then. A total of 199,000 $OP tokens is used for budget calculations, the actual final amount depends on when the repurpose is approved (if it is approved).

Grant Overview

Balancer has demonstrated its ability to execute on a similarly structured program and drive the growth of yield-bearing assets. The repurposed grant would use a straightforward distribution mechanism where the rewards are deposited based on the pool’s relative TVL compared to the total TVL of the boosted pools. A portion of tokens is set aside for pool bootstrapping incentives.

Grant Distribution Plan

Balancer plans to utilize the OP grant for liquidity incentives to bootstrap and accelerate growth of Boosted pools on Optimism using Balancer’s tech. The purpose of this grant is to generate economic activity on Optimism by building an autonomous mechanism for distributing incentives in the form of OP to incentivize boosted pools on Balancer.

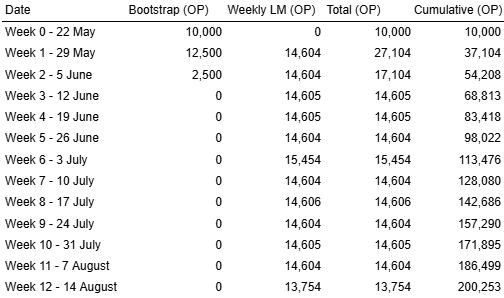

The OP is distributed between eligible pools based on their relative TVL, which is found based on the TVL weight of the pool relative to total TVL of all the boosted pools. Pools that contain only boosted tokens receive a 1.5x multiplier for their TVL. The tokens are deposited on a weekly basis as direct LM incentives, with all the rewards distributed between the liquidity providers:

![]()

Extra Pool Bootstrapping Incentives

In addition to the OP grant distribution plan described before, a portion of the OP tokens will be used to bootstrap up to 5 new boosted pools with an initial bonus of 5000 OP tokens for 2 weeks (2500 OP weekly). In case not all bootstrapping incentives are used, these would be added as extra rewards to the last 2 weeks of the grant.

Token distribution timeline

The repurposed grant distribution would be evenly split across the grant period into weekly amounts to augment incentives on Balancer’s boosted pools on the Optimism chain. The grant is set to last for 12 weeks from the first distribution date. Thus the weekly OP incentives would be set to:

![]()