ether.fi: Optimism Liquid Staking Proposal

Submitted by: Tyson Wynne (Business Development at ether.fi)

Action Requested: Mint 6,400 ETH worth of weETH, bridge it to OP Mainnet, and use it to seed OP-native liquidity or hold in treasury to earn ETH-denominated yield.

Overview

This proposal requests approval for the Optimism Collective to allocate 6.4K ETH from its treasury into weETH, EtherFi’s non-rebasing liquid restaking token deployed on OP Mainnet.

weETH has emerged as the leading restaking asset in DeFi and is now the largest ETH-staking asset on Aave, a signal of broad and durable adoption across active onchain participants—retail users, sophisticated DeFi users, funds, institutions, and onchain treasuries.

As DeFi has matured, weETH has become a preferred treasury asset for organizations seeking reliable ETH-denominated yield and seamless access to liquidity and lending markets. This includes major public companies such as Sharplink Gaming Inc., GameSquare Holdings, and ETHZilla, each of which has deployed portions of their ETH treasuries into weETH to participate more deeply onchain and across DeFi on Ethereum.

The allocation delivers three direct benefits:

- ETH-denominated yield for the Treasury through Ethereum staking + EigenLayer restaking rewards.

- Liquidity bootstrapping for OP DeFi, enabling weETH to become a core collateral asset across Aave, Morpho, Spark, and OP-native DEXs.

- Superchain-wide ecosystem growth, leveraging EtherFi’s proven success scaling weETH liquidity and integrations on Base, Unichain, and upcoming networks like Ink.

weETH is fully backed 1:1 by staked ETH and integrated across 200+ DeFi protocols and 17 chains, supporting the diverse and growing set of users and treasuries that have adopted it as a core onchain asset.

Design

EtherFi is a non-custodial pooled Ethereum staking and native Eigenlayer restaking protocol built around two core assets:

- eETH – a rebasing LRT backed by staked ETH, with redemptions prioritized through an unbonded ETH buffer and fallback validator exits.

- weETH – a wrapped, non-rebasing ERC-20 using a share-based exchange rate for deterministic DeFi integrations, inheriting all eETH yield and redemption mechanics.

Architecture components::

- Pooled Validator Network: EtherFi delegates stake across a decentralized set of professional node operators.

- Staking & Restaking Pipeline: Deposited ETH enters validator activations on Ethereum mainnet and is natively restaked into EigenLayer, enabling stakers to earn consensus rewards, execution rewards, and restaking incentives (distributed weekly as KING → ETHFI + EIGEN).

- Redemption & Liquidity Layer: Fast withdrawals served via an ETH buffer; longer withdrawals served by validator exits.

- Reward Accounting: all rewards accrue into the share-rate of eETH/weETH + restaking to rewards into the KING token.

weETH inherits the full backing, redemption pathway, and safety guarantees of eETH.

Reference: ether.fi Staking | Gitbook

Risk & Mitigations

Governance

EtherFi Governance is currently progressing under a Foundation-plus-DAO model (Snapshot voting + onchain execution):

- Foundation Charter + Multisig Committee: operational oversight and handling emergencies.

- Community Participation via voting stack: governance forum + Snapshot + onchain execution.

The EtherFi governance model focuses on:

- Decentralized Decision-Making: Empowering the community to participate in protocol upgrade decisions along with spending or transfers from the Treasury.

- Security and Efficiency: Ensuring that changes are made in a secure and timely manner.

- Checks and Balances: Implementing a robust voting system that values expertise, reputation, and commitment to our vision, while holding contributors accountable.

Reference: EtherFi Governance Forum

Collateral & Financial Performance

Amount of assets secured by EtherFi protocol on OP Mainnet

661 ETH is currently deployed on OP Mainnet via weETH.

Reference: Dune Analytics — ether.fi L2 Supply Dashboard

Total Amount of assets secured by the EtherFi Protocol across EVM Blockchains

EtherFi currently secures approximately 2,503,024 ETH (~$8.44B) across Ethereum and major L2 ecosystems. This scale places EtherFi among the largest and most trusted staking and restaking platforms in the industry, with broad distribution across mainnet, L2’s and the leading EVM blockchain ecosystems.

weETH is the largest liquid staking asset on the Superchain with roughly ~123k weETH. Largely across Base and Unichain.

Importantly, Base—part of the Optimism Superchain—already demonstrates the scale weETH can achieve in an OP-Stack environment: 118,093 weETH is supplied on Base, making it the largest weETH deployment across all L2s, and weETH is the #2 most supplied asset on Aave on Base, second only to ETH itself. This traction of weETH on Superchain and L2 infrastructure provides a clear signal that OP Mainnet can support similar depth and adoption with proper support from the Optimism Collective.

References: ether.fi Dune Analytics; Hildobby Ethereum Staking Data

Peg Health & de-pegging events in the last 12 months

No issues. Based on 12 months of data (Nov 2024–Nov 2025), sampled every 4 hours, weETH demonstrates the strongest and most consistent peg stability of any LRT — and its peg performance is best compared with the stability profile of stETH.

Across ~1,000 observations, weETH maintained an exceptionally tight trading band with smooth mean reversion, no ≥1% de-pegs, and only two brief single-interval prints above 0.50%, each resolving immediately. The asset exhibited a low average deviation of ~0.09% and stable cross-venue pricing, supported by deep liquidity.

Additionally, weETH is always fully redeemable 1:1 to ETH via the withdrawal queue.

| Metric |

weETH |

stETH |

ezETH |

rsETH |

| Average Peg (mean) |

-0.071% |

-0.109% |

-0.161% |

-0.132% |

| Max Depeg |

-0.600% |

-0.420% |

-0.441% |

-0.965% |

| Standard Deviation |

0.091% |

0.076% |

0.083% |

0.089% |

| % of Days Below -0.15% |

19.000% |

22.900% |

37.200% |

35.256% |

Reference: LRTs Premium/Discount Rates vs Market Values

Process for technical upgrades

All EtherFi contract upgrades follow a strict security pipeline: new code undergoes audits, testing, and formal verification where applicable, then is published open-source for external review. Any upgrade must pass through a 72-hour timelock and be executed by the protocol multisig, ensuring transparency and giving stakeholders time to review the exact changes before they go live. Emergency pause controls exist for critical issues, but all standard upgrades follow the same audited then timelocked process, providing a secure and predictable upgrade path.

Note: More details in System Upgrade Process below

Liquidity Risks

- No slippage on staking: Converting ETH → eETH via the EtherFi staking contract has zero slippage and is 1:1.

- Large redemption buffer: EtherFi currently has a ~37,571.5 ETH liquidity buffer to satisfy weETH→ETH withdrawals. If needed, the protocol exits validators to replenish liquidity and maintain the liquidity buffer.

- Deep DEX liquidity: weETH currently has ~$140M (42,473 ETH) in multi-chain DEX liquidity, supporting tight spreads and fast peg reversion.

- LayerZero bridging: weETH supports LayerZero, enabling fast bridging to Ethereum mainnet where deeper liquidity venues exist, providing an additional backstop for large withdrawals.

Reference: ether.fi Liquidity

Regulatory risks

EtherFi firmly believes that the Ethereum network will become the settlement layer for global financial markets. Our convictions, however, are not guarantees about the future. Cryptocurrencies and Ethereum in particular have made the leap from niche to mainstream and this increase in prominence has been accompanied by an increase in governmental scrutiny. Any number of well-meaning and / or ill-informed public policies can temporarily or permanently derail the protocol, including but not limited to: bans on cloud service providers providing services to crypto related enterprises bans on ISPs providing crypto related services onerous taxes levied on various network transactions etc. We have taken every measure necessary to keep ourselves out of regions with heavy government scrutiny.

Yield / Fees

Historical & Projected Yield

EtherFi’s historical yield is composed of two components: Ethereum staking rewards and EigenLayer restaking rewards distributed as KING. Across the past 12 months, base Ethereum staking returns for eETH have averaged 2.8–3.2% APR, which is consistent with network-wide validator performance. Restaking rewards via KING have added an additional 0.4–0.8% APR on average over this period, based on weekly distributions. Taken together, historical total yield for weETH has trended in the 3.2–4.0% APR range.

Going forward, yields are expected to remain in line with Ethereum staking returns, with incremental upside driven by upcoming restaking incentives and AVS maturation.

Reference: DeFiLlama weETH, ether.fi: KING rewards distribution, EtherFi eETH Staking

Fees / Comission

- Stakers receive 90% of all staking + restaking rewards.

- The remaining 10% is split between:

- 5% to node operators

- 5% to the protocol (operations + security)

No additional fees — no spreads, no withdrawal fees, no hidden charges beyond normal Ethereum gas.

Strategic Benefits

How EtherFi & Optimism would strategically grow OP Mainnet ecosystem around weETH

EtherFi has already executed this playbook across the Superchain: on Base, early liquidity turned weETH into one of the dominant assets on the network and the second-largest collateral on Aave behind ETH; on Unichain, weETH is live as the largest liquid restaking asset; and Ink is next. The same growth curve is available to Optimism. If the OP Treasury mints weETH and seeds a 50/50 weETH/ETH pool on Velodrome, it establishes the liquidity depth required for risk teams to green-light collateral onboarding. That liquidity unlocks the path to Aave → Morpho → Spark listings on OP Mainnet, enabling weETH to become a core borrow/lend asset on Optimism.

From there, EtherFi will drive the ecosystem expansion: preparing the full Aave onboarding package, coordinating with risk teams, pushing collateral caps safely, supporting Morpho and Spark integrations, and working with builders, LPs, and institutional users to grow adoption. Treasury involvement kick-starts the flywheel, and EtherFi executes the growth—mirroring the path already proven across the broader Superchain.

In the early phase, EtherFi’s priority on OP will be securing the Aave listing for weETH. This unlocks deeper ETH supply, healthy borrow demand, and the ETH-denominated leverage and hedging activity that make an ecosystem self-sustaining. Treasury-backed liquidity provides the depth, price stability, and volatility profile required for risk teams to approve initial caps. EtherFi will handle the technical, risk, and governance work needed for a smooth listing.

If the Optimism Treasury prefers not to seed liquidity directly, EtherFi can work with external LPs and partners to support Velodrome depth instead. Treasury seeding is simply the most efficient catalyst, but alternative paths exist.

Additional Economic benefits for OP Mainnet and the Superchain ecosystem

Deep weETH liquidity boosts OP’s economic throughput:

- Higher transaction volume across swaps, lending, borrowing, and yield strategies

- Increased fee revenue for OP-native DEXs and protocols

- Stronger collateral bases + improved capital efficiency

- Higher TVL across OP money markets

- Strengthened Superchain alignment, matching Base’s growth curve

- Institutional inflows, driven by treasury participation and ecosystem credibility

Rewards Share:

- If the Optimism Collective allocates the Liquid Staking portion of its treasury to weETH, EtherFi will provide a reward-sharing arrangement that increases net yield back to the treasury. EtherFi will return 1% of gross staking + restaking yield to the Optimism Treasury, effectively reducing protocol fees on the Collective’s weETH position. These rewards are distributed quarterly to a designated Treasury address and operate as a recurring economic benefit layered on top of staking and restaking returns.

Security

EtherFi’s core and auxiliary contracts have been rigorously audited and formally verified by leading firms including Certora (continuous formal verification and rolling audits throughout 2025), Nethermind, Zellic, Halborn, Solidified, Omniscia, Paladin, Decurity, and CertiK, with all public reports available in the EtherFi audit index. Issues identified across reports have been remediated or formally acknowledged with justification prior to deployment, and Certora provides ongoing post-remediation hardening and regression checks. Security is further reinforced through a timelocked multisig upgrade process, isolated admin wallets, and an active Immunefi bug bounty program, ensuring the protocol maintains institutional-grade security and transparent upgrade practices.

Recent audit focus areas (2025):

- weETH withdrawals and adapter redesign (Certora)

- Pectra-readiness upgrades (Certora)

- Instant withdrawals + withdrawal-fee logic (Certora re-audit)

- EigenLayer slashing-related safety checks (Certora)

- Cumulative Merkle distribution mechanics (Certora)

Public audit index: Audits | ether.fi

Monitoring

- Certora – Continuous Audit Review & Formal Verification:

- EtherFi gets continuous audit review on our smart contracts by the Certora team instead of a one-time audit to be on top of any security issue that might arise.

- Mathematically proves core contract logic correctness, adding rigorous guarantees beyond standard audits.

- Hypernative – Real-Time Risk Automation:

- Monitors all on/off-chain activity and can automatically freeze protocol functions in response to critical threats—safeguarding assets under management.

- Chaos Labs – Strategic Risk Partner:

- Develops AVS/LRT frameworks, risk dashboards, and asset onboarding + liquidity assessments. Powers live risk oracles and scenario-based stress testing.

Bug Bounty Information

- Current program: Hosted on Immunefi — EtherFi’s official bug-bounty portal is live and publicly accessible. For example, the program listing notes maximum bounties up to USD $200,000. (ether.fi Audit Competition on Immunfi)

- Previous competition: A dedicated audit competition was held via Hats Finance on the Hats platform, open to the community and publicly listed. (ether.fi Audit Competition on Hats.finance)

- Historical data:

- The Immunefi program has been live since March 2024 and is still active.

- The Hats Finance competition is documented via a public leaderboard repository.

System Upgrade Process

- Timelock (4/7 Multisig): All core protocol upgrades require 72-hour delay, ensuring transparency & time for stakeholder review.

- Emergency Controls (⅗ multisig pauser): Critical contracts can be paused immediately in emergencies (e.g., oracle failure, exploit). Procedures are monitored and enforced by Hypernative.

- All contracts owned by secure multisigs: Core contracts are governed by hardware backed multisigs with high thresholds and timelock.

- Isolated admin wallets: Admin wallets are dedicated to core protocol activity only – no outside transactions, no exposed approvals to reduce external risk.

- Upgradable contracts with strict oversight: Core contracts use upgradeable patterns, but all changes require multisig + timelock authorization.

- Multisig administered by key stakeholders: Admin access is controlled via a multisig consisting of internal team members and trusted external stakeholders, with signers geographically distributed to mitigate centralized risk.

Client Information

EtherFi’s validator set is operated by a diverse group of professional node operators running multiple independent Execution (EL), Consensus (CL), and Validator (VC) clients. This diversity reduces correlated risk and strengthens resilience across the network.

Across the operator set, the following clients are actively used:

- Execution clients: Geth, Reth, Nethermind, Besu

- Consensus clients: Lighthouse, Prysm, Teku, Lodestar, Vouch, Nimbus

To ensure operational resilience, operators employ a mix of:

- High-availability architectures (active/standby EL + CL pairs with slashing-safe failover)

- Distributed Validator Technology (DVT) using SSV clusters across multiple regions

- Geographically and infrastructure-diverse deployments (bare-metal + SOC2 + multi-cloud, multi-AZ separation)

- Automated orchestration using Kubernetes for rapid self-healing and failover

- 24/7 monitoring and alerting for validator performance, client health, and network conditions

This combination of client diversity, fault-tolerant validator setups, and multi-region infrastructure ensures EtherFi maintains a resilient, redundant, and Ethereum-aligned validator network.

Transparency & Reporting

The EtherFi ecosystem provides multiple public dashboards to ensure complete transparency into staking performance, liquidity, and protocol activity:

- Protocol-Level Dashboard (Dune): Displays total assets secured, L2 adoption, wallet distribution, liquidity metrics, and cross-chain flows for the entire EtherFi protocol.

- eETH / weETH Staking Dashboard (Dune): Tracks real-time and historical staking flows, TVL, redemptions, and yield dynamics across eETH and weETH.

- Rated Pool Performance: Provides detailed staking-pool performance data, including APR, validator behavior — giving a clear view of operational health and long-term performance.

- EtherFi Eigenlayer Allocations: Review all Eigenlayer allocations from EtherFi.

- Chaos Labs Risk Dashboard

- EtherFi Dune Portal

Together, these dashboards offer real-time, on-chain visibility into yield generation, peg stability, liquidity conditions, and adoption trends. This ensures the Optimism Collective can continuously monitor the performance and security of its allocated weETH.

Roadmap

Timeline

Deployment can occur immediately upon approval. weETH is already fully live on OP Mainnet, with deployed contracts.

Deployment timeline:

- Week 0–1: ETH → mint weETH → bridge to OP via Stargate

- Week 1–2: (Optional) Collaborate to seed weETH/ETH liquidity on Velodrome

- Week 1–4: Submit Aave onboarding package (with Chaos Labs)

- Post-approval: Go-live on Aave; expand caps; pursue Spark + Morpho listings

Total time to full proposal activation: ~4 weeks, with deployment and rewards accruing from day one.

Milestones

- Treasury Conversion (Week 0–1): Convert 6.4K ETH → weETH on OP; begin yield accrual

- Velodrome Liquidity (Week 1–2): Launch weETH/ETH pool; target depth/low-slippage bands.

- Aave Listing Prep (Week 2–4): Submit Aave onboarding package (risk, oracle, caps) with Chaos Labs.

- Go-Live & Scale (Post-approval): Activate Aave listing on OP; raise supply/borrow caps as liquidity scales.

- Comms (lightweight): Joint OP × EtherFi announcement; ongoing markets and growth updates.

Treasury operations approach for deploying the Collective ETH to your LST?

The recommended flow:

- Stake ETH on Ethereum mainnet → receive weETH.

- Bridge weETH to OP via Stargate (~$0.005 + gas).

- Deploy into Velodrome or hold in Treasury wallet.

EtherFi can work directly with the Treasury’s wallet or custody provider if direct minting support is preferred. (Utila, Safe, Anchorage, Fireblocks, etc.)

Success Metrics

To be finalized jointly with the Optimism Collective. Core metrics include:

- ETH-denominated yield generated by the Treasury

- weETH TVL growth on OP

- Depth of weETH/ETH liquidity pools

- Aave/Spark/Morpho weETH integration metrics (caps, utilization, borrow demand)

- Trading volume + user activity across OP DeFi

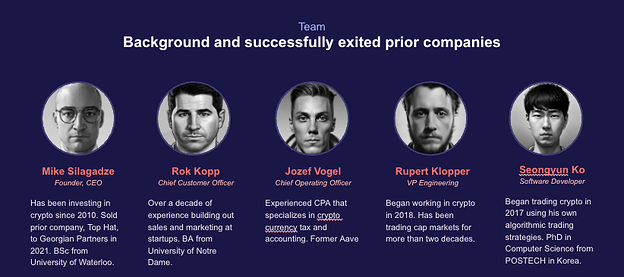

Team

Founders

EtherFi Team Experience & Track Record

EtherFi’s team has a proven history of building, scaling, and operating mission-critical crypto infrastructure. The founding team includes operators with prior company exits to IPO and private equity, and decades of combined experience across trading, engineering, cybersecurity, and crypto markets. This fully doxxed, globally distributed team has consistently delivered products that scale.

Starting with Stake (eETH/weETH), EtherFi has built Ethereum’s largest native restaking platform, now securing over 2.48M ETH and serving more than 200,000 wallets across retail, funds, institutions, and onchain treasuries. Building on this foundation, the team successfully expanded into EtherFi Liquid and Cash, both of which have seen strong adoption and reinforced EtherFi’s position as a vertically integrated, multi-product ecosystem powered by Ethereum.

weETH has become a blue-chip DeFi primitive, integrated across 200+ protocols and deployed on 17 chains. Major public companies—including Sharplink Gaming, GameSquare Holdings, and ETHZilla—now use weETH as a core treasury asset, highlighting the protocol’s reliability and institutional readiness. This blend of operational maturity, execution velocity, and demonstrated ability to scale positions EtherFi as a capable and long-term aligned partner for the Optimism Collective.